Insurance Frontends

Our solutions range from ready-to-use blueprints to complete platforms and individual, stand-alone building blocks - all tailored to your unique needs. Designed for fast, seamless integration with existing systems, they cover every aspect of insurance — from intuitive self-service portals, agent and broker tools, customer service, online sales & payments, investment management and claims handling.

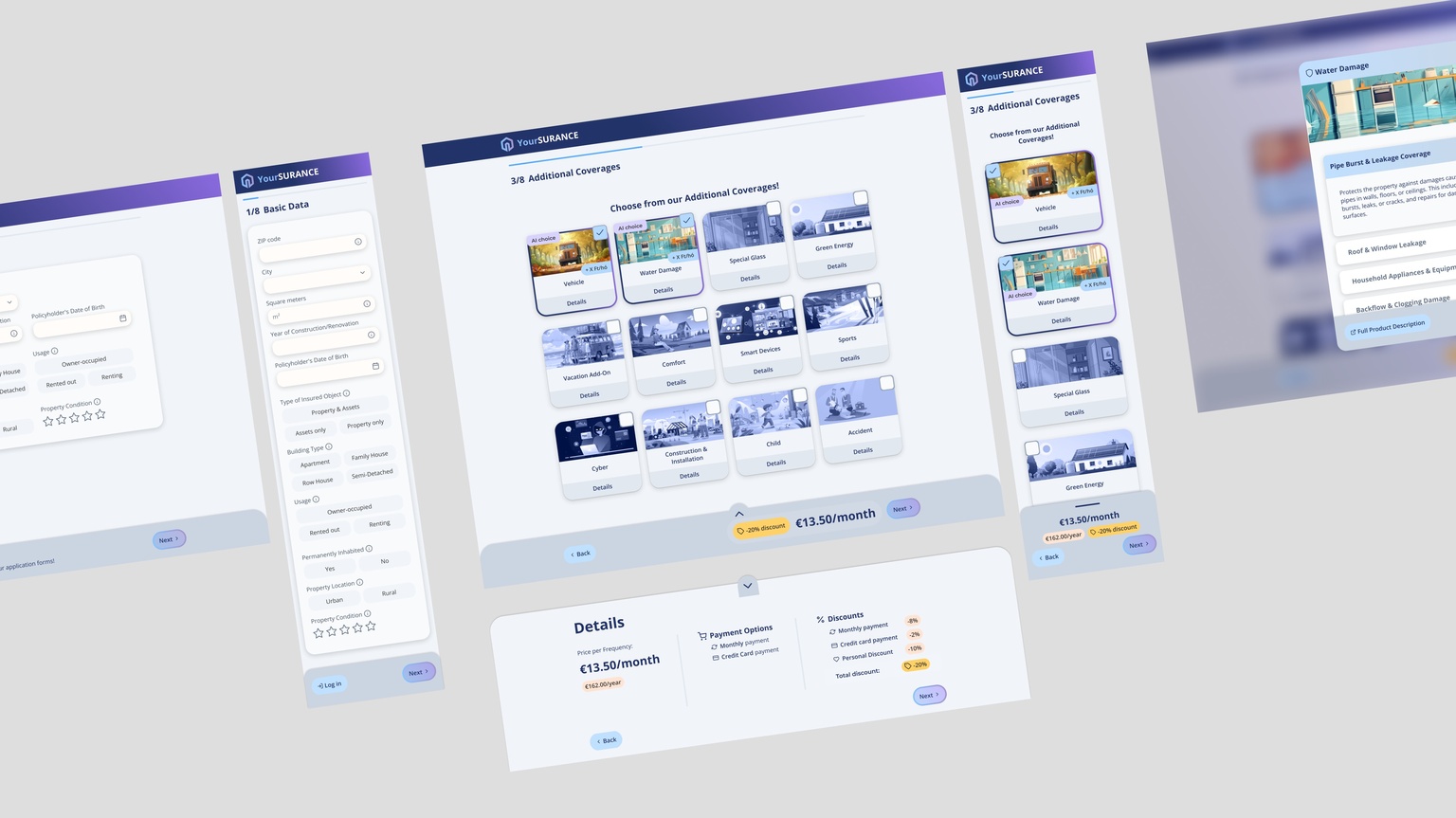

Customer Portal – a self-service digital platform

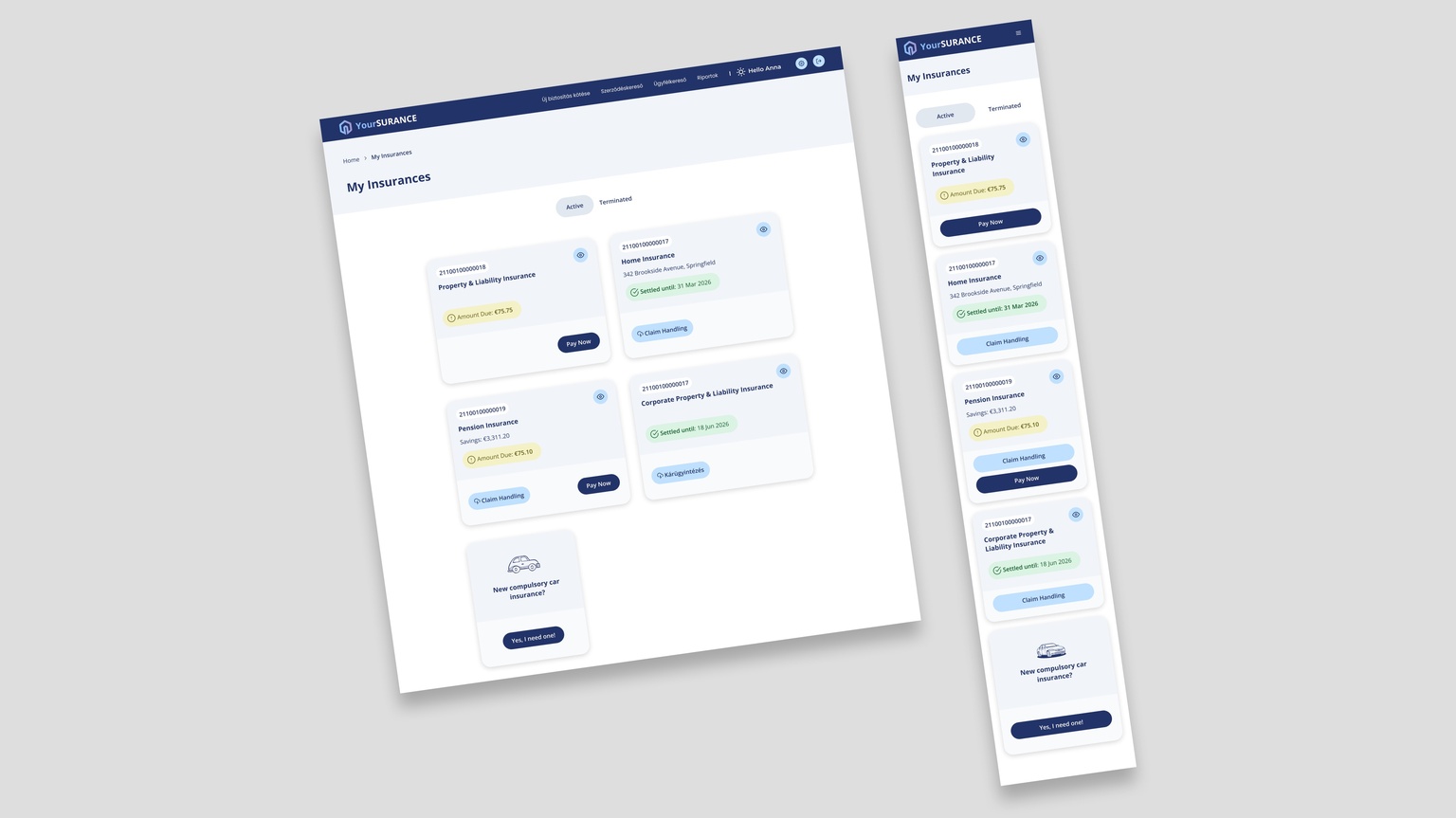

Give your policyholders the freedom to manage their insurance anytime, anywhere — from claims to payments — all in one secure online hub.

Our Customer Portal goes beyond basic self-service. It provides a seamless, user-friendly experience where customers can access detailed policy information, track claims in real time, adjust investments, update personal details, and more. Built for both convenience and efficiency, it enhances customer engagement while reducing operational costs and easing the workload on your service teams.

Our advanced Digital Quoting & Underwriting modules equip your sales force and channels with a fast, comprehensive solution for the entire proposal process. From instant premium calculation and precise tariffing to intelligent product recommendations and seamless rules engine integration, complex tasks are automated. With built-in e-signature and document generation, policies can be issued fully digitally — enabling paperless operations, faster sales, and smoother contract finalization.

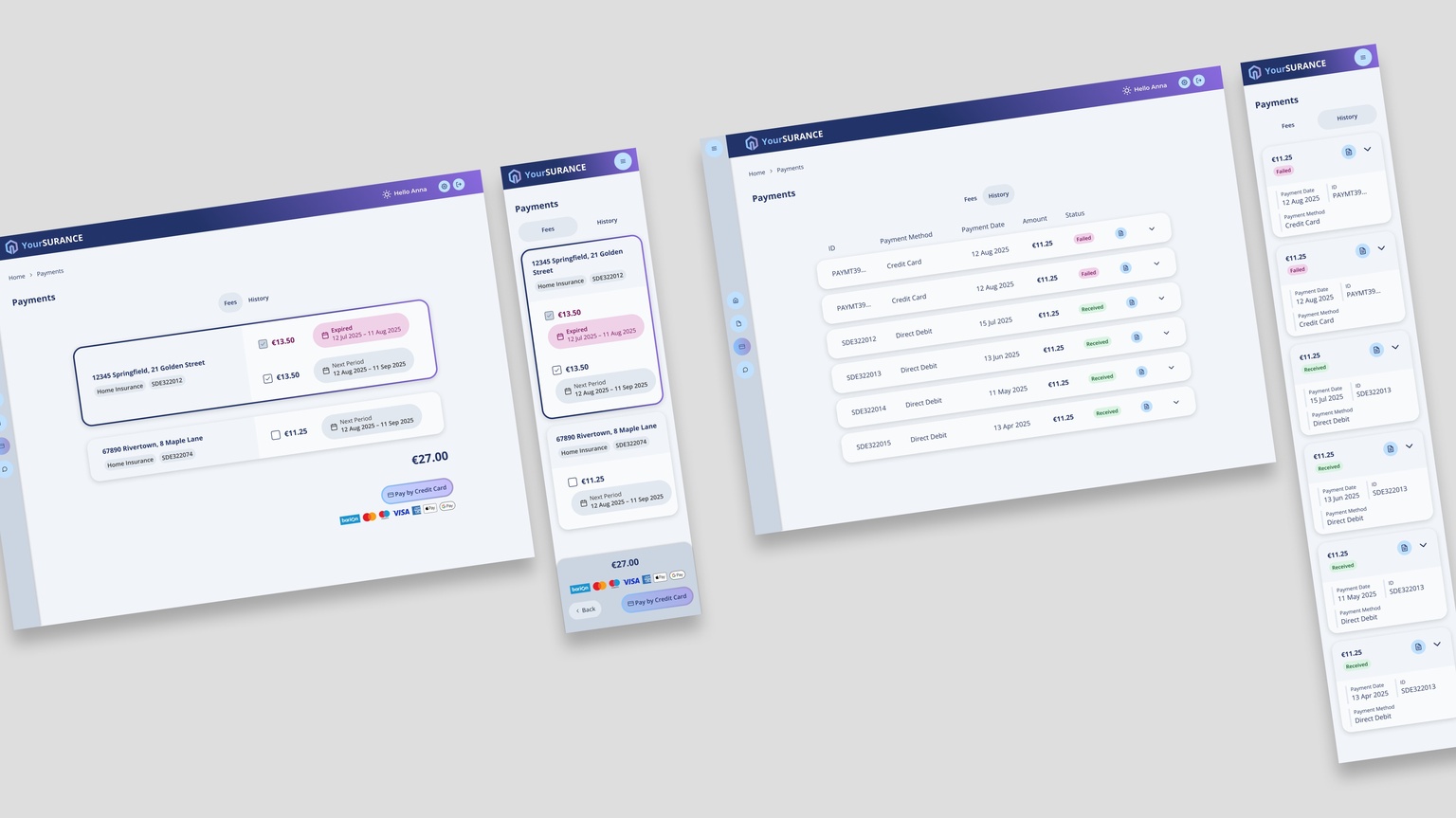

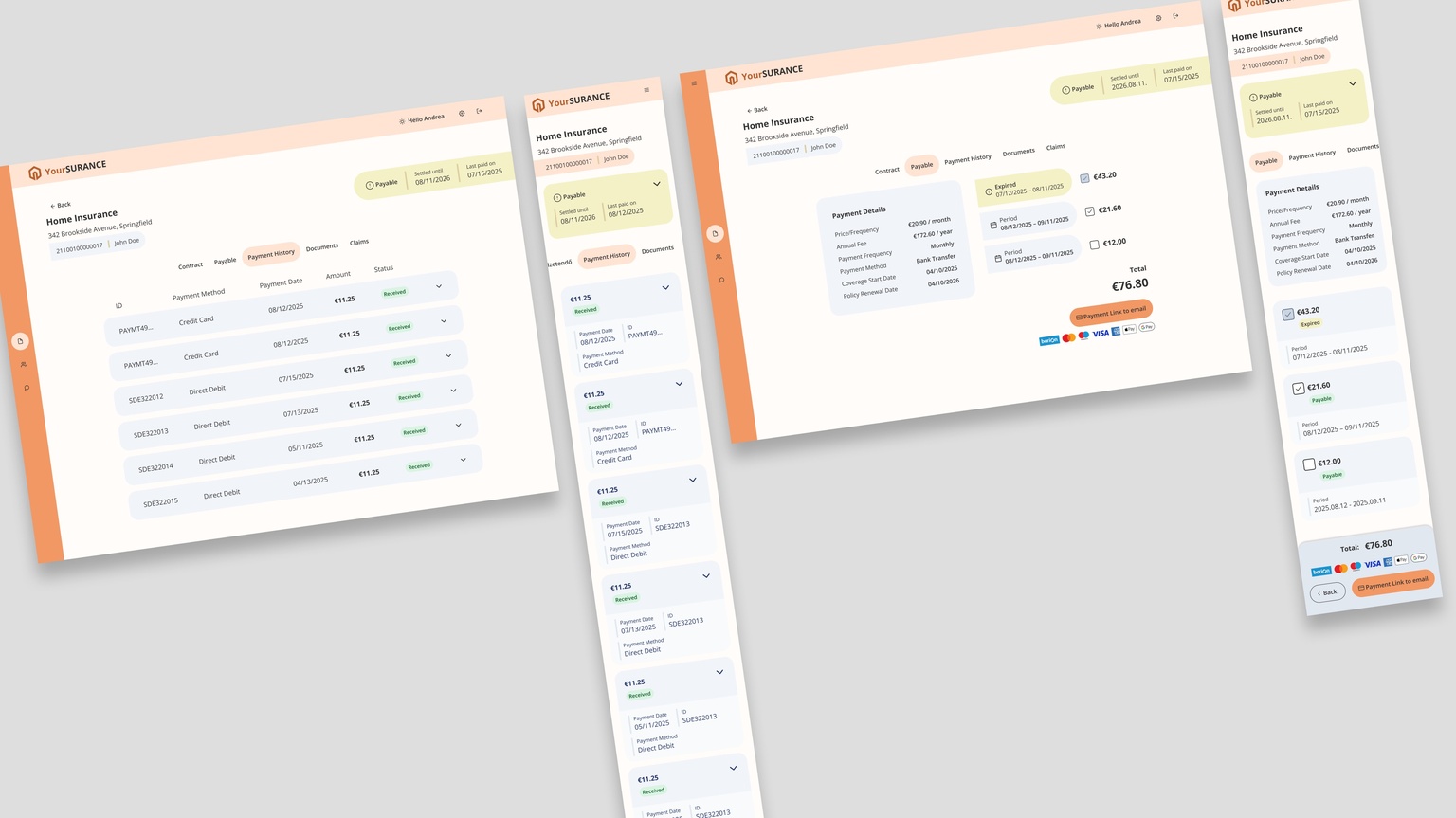

Our integrated online payment solution gives policyholders a secure, user-friendly way to manage premiums and liabilities instantly. Supporting multiple payment options, it ensures smooth transactions, improves completion rates, and simplifies financial interactions for your clients.

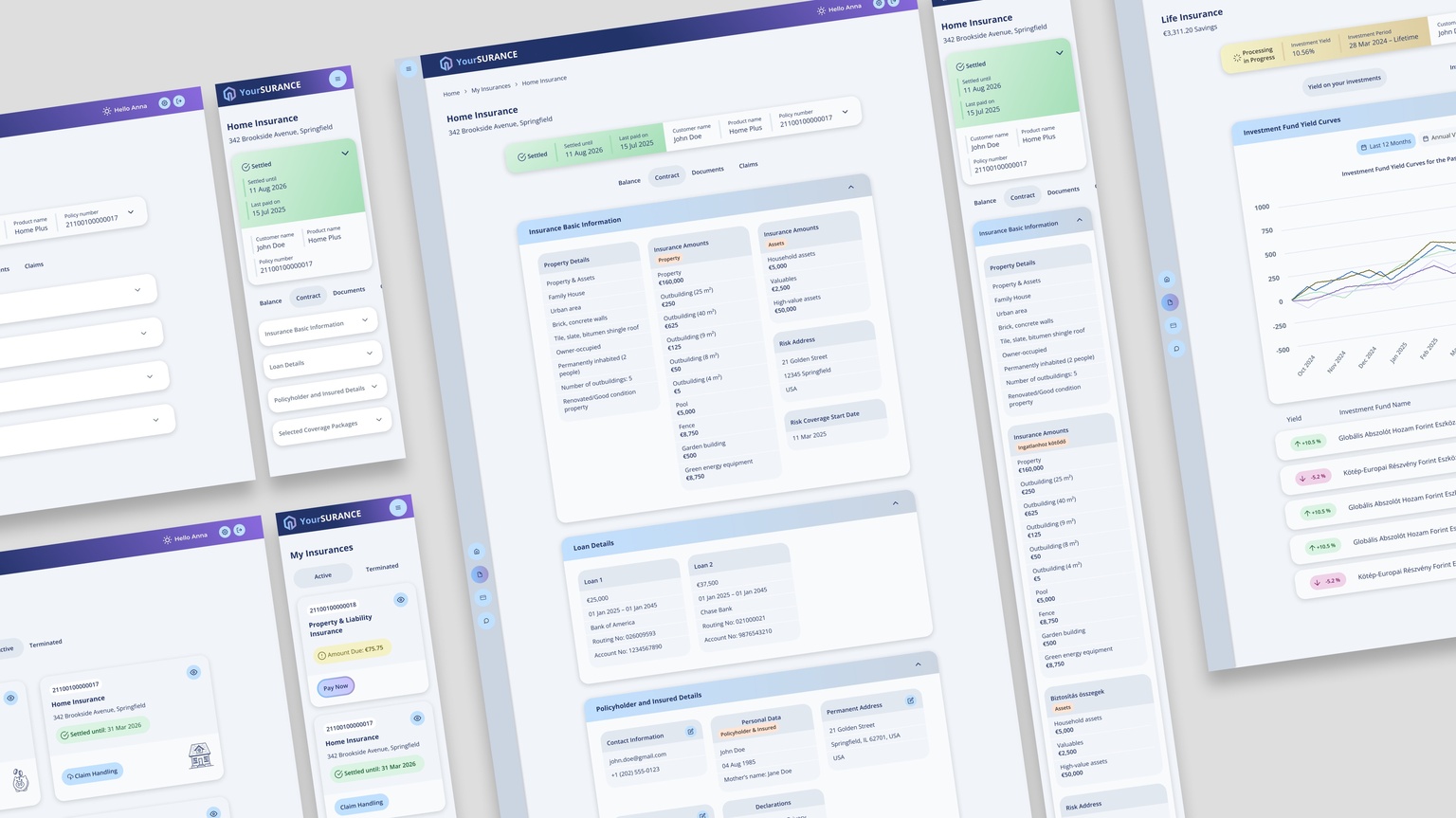

Give policyholders full control over their insurance portfolio with instant, transparent access to detailed policy overviews — from coverages and terms to discounts, savings, surrender values, and beneficiary details. Beyond viewing, the platform enables seamless self-service policy updates, ensuring information stays current and accurate. The result: higher customer satisfaction, reduced administrative workload, and greater operational efficiency.

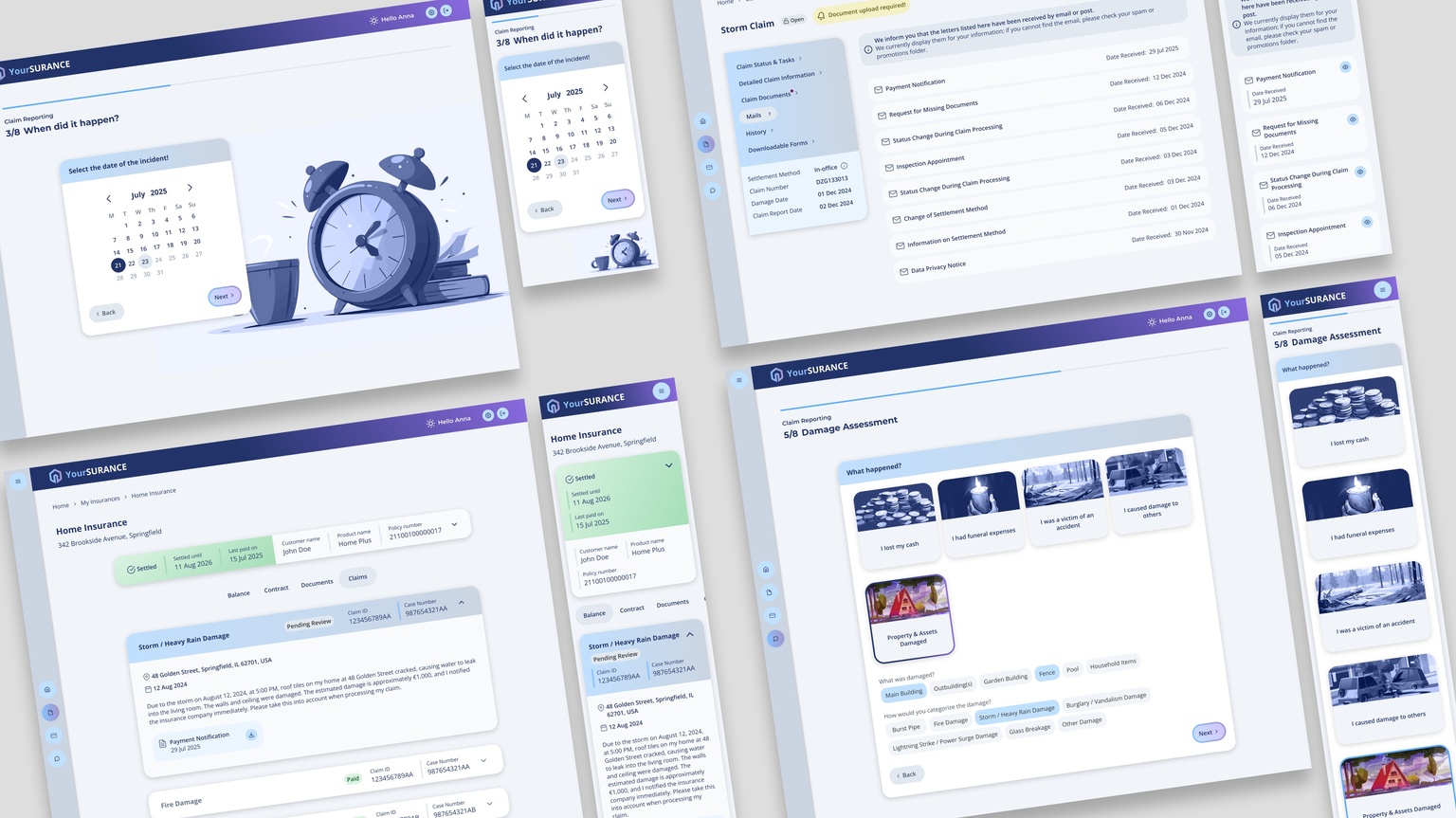

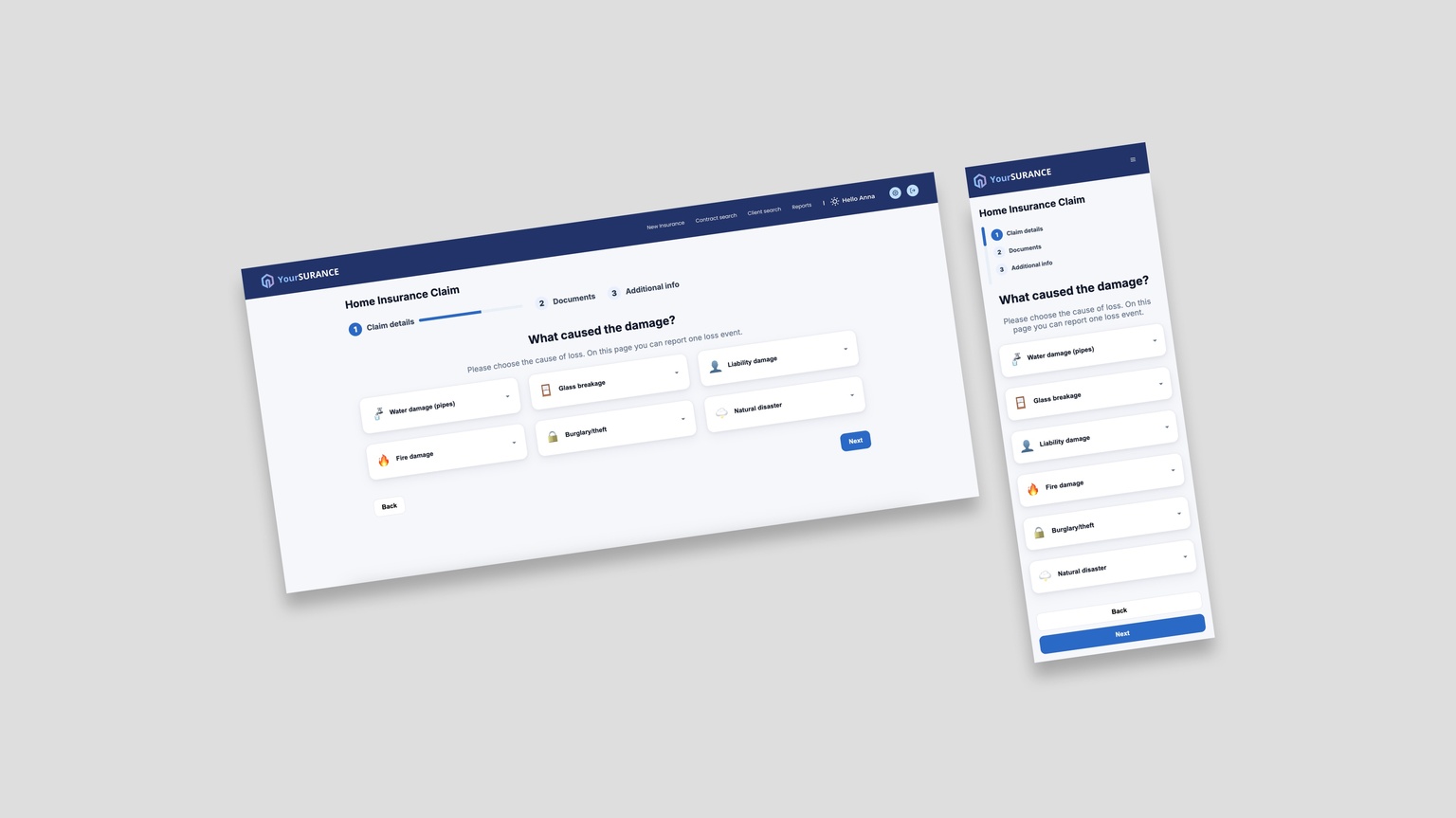

Our Customer Portal transforms the claims experience by putting policyholders in control. With intuitive online claim submission, clients can file claims step by step, while the integrated Claim Tracker provides real-time updates from assessment to settlement. A secure document-handling feature enables easy upload and download of all claim-related documents, ensuring transparency and reducing administrative effort for both customers and insurers.

Lead tracking

Customer management and offer customisation

Customer History, existing contracts, interaction records

Client profile management

Workflow management

Alerts, to-dos, follow-ups

Product recommendation

Underwriting

Portfolio view

Policy details

Payment mode

Customer data modification

Claim entry

Claim Tracker and document handling module

Campaign Management

Agent and Broker Platform

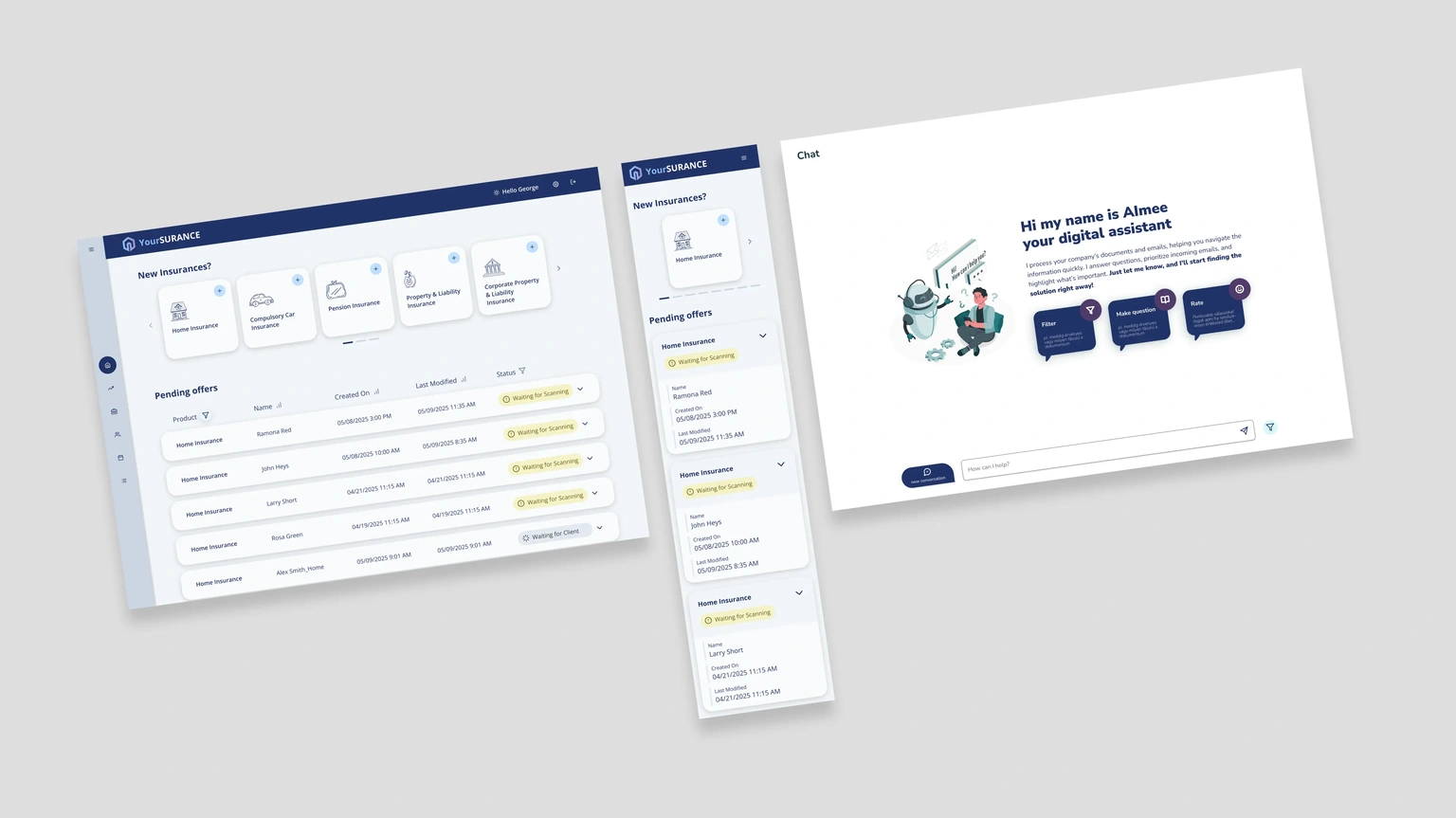

Equipping your agents and brokers with a powerful, all-in-one digital platform to streamline sales, simplify policy management, access real-time client data, and enhance their efficiency on the go.

Our sophisticated Agent and Broker Platform is engineered to empower your sales force, wherever they are. Providing a centralized hub, it offers comprehensive tools for digital quotation and contract generation with e-signature, real-time access to customer profiles and policy portfolios, and robust sales workflow management. Agents and brokers can effortlessly track leads, analyze performance with integrated KPIs, utilize product comparison and cross/upsell tools, and access embedded training – ultimately boosting productivity, accelerating sales cycles, and fostering stronger client relationships.

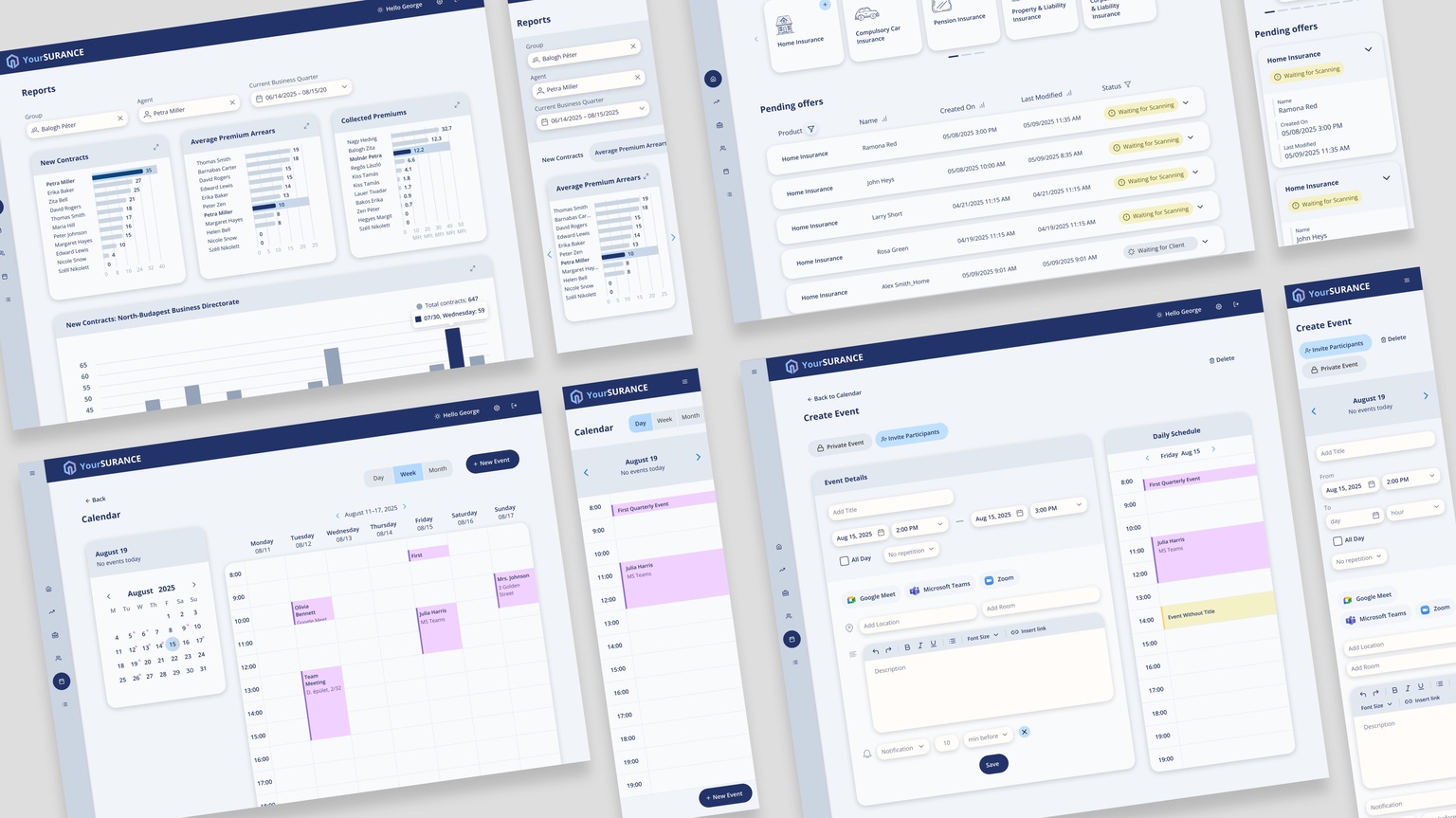

Our Agent and Broker Platform is meticulously designed to optimize daily sales operations, whether in-branch, in the field, or online. At its core is a personalized dashboard that delivers instant, actionable insights into performance metrics, sales opportunities, and client activity. A robust calendar supports scheduling, task management, and timely follow-ups — and optional CRM integration extends these capabilities even further. Together, these tools keep agents productive, organized, and proactive — strengthening client relationships and driving sales success.

We provide robust tools for end-to-end campaign management, enabling agents to plan, execute, and monitor targeted marketing and sales initiatives from a single hub. To complement this, the platform delivers embedded product training and extensive documentation, ensuring your team always has up-to-date knowledge to confidently present offerings and deliver superior client advice. With our optional AI-powered chatbot, agents can easily find answers to even their most complex questions.

The platform supports sales professionals with intelligent cross-sell / upsell recommendations to maximize revenue. Furthermore, it provides comprehensive sales statistics, KPIs, and performance tracking, including detailed commission statements, ensuring the transparency and oversight necessary for continuous, data-driven decision-making.

No additional hardware (such as a card reader) is required, making it a more affordable alternative. Agents can accept payments anywhere with a smartphone, making it ideal for serving customers on the go. Our Agent Platform is able to integrate the Tap to Phone solutions in EU. This feature enables fast, contactless transactions, reducing payment processing time so insurance companies can serve more customers efficiently.

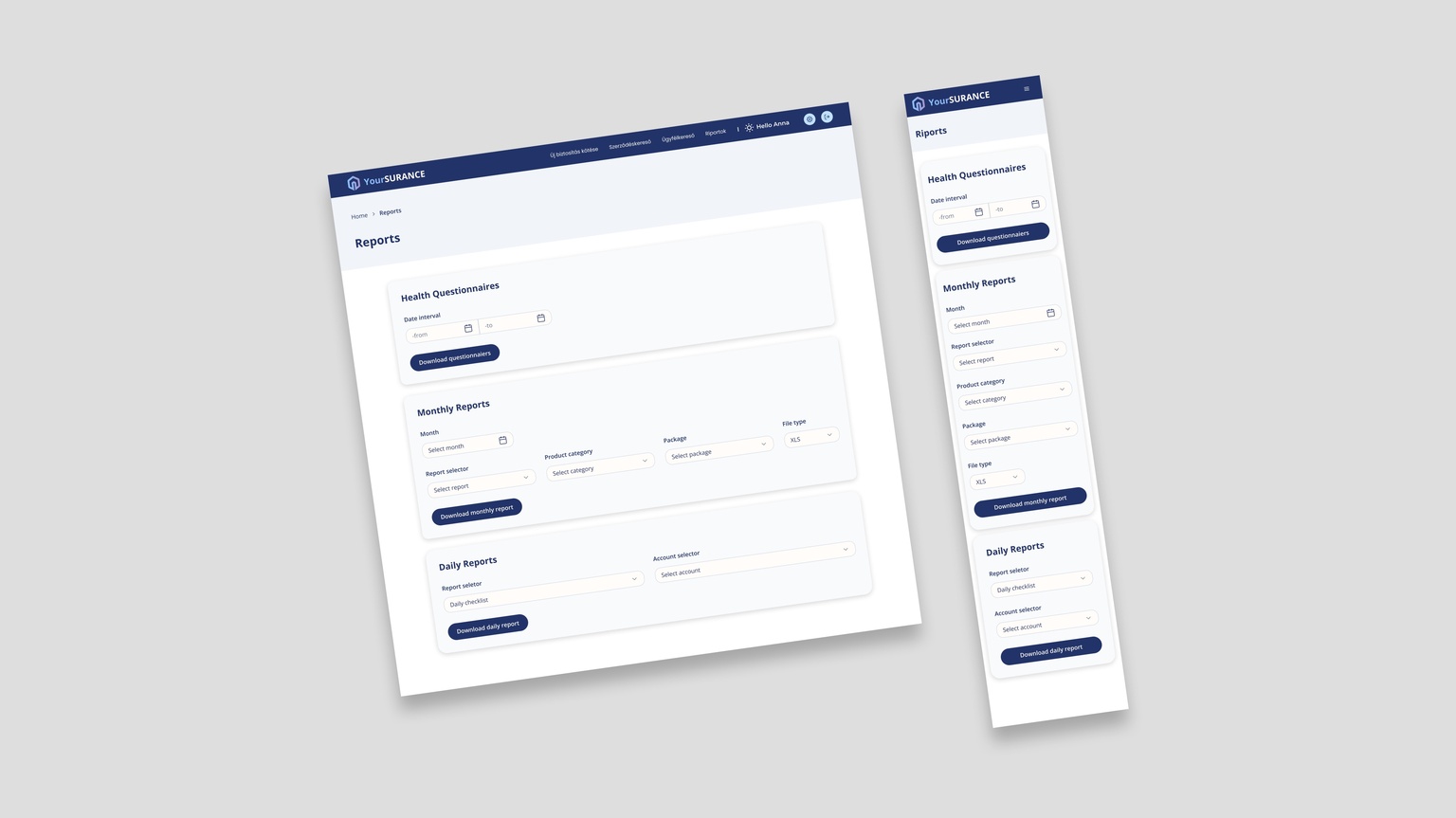

Dedicated management views offers real-time visibility into team performance, sales pipelines, and client activity across all channels. Managers can track KPIs, monitor progress against targets, and drill down into individual or branch-level results. With built-in dashboards and reporting, leadership gains the insights needed to coach teams effectively, allocate resources wisely, and drive consistent growth.

Lead tracking

Customer management and offer customisation

Customer History, existing contracts, interaction records

Client profile management

Product recommendation

Underwriting

Portfolio view

Policy details

Payment mode

Customer data modification

Claim entry

Customer Service Platform

Optimizing your customer support operations with a unified platform for efficient inquiry management, real-time customer history access, automated communication, and seamless issue resolution, enhancing overall service quality.

Our sophisticated Customer Service Platform provides a central nervous system for your support teams, enabling truly exceptional service. It unifies all customer interactions and historical data, facilitating real-time access to detailed client profiles, policy overviews, and interaction logs. The platform streamlines inquiry routing, automates routine responses via intelligent email processing or chatbots, and provides agents with comprehensive knowledge bases and product training. This empowers your service representatives to resolve complex issues efficiently, enhance personalization, and build lasting customer loyalty while significantly reducing operational burdens.

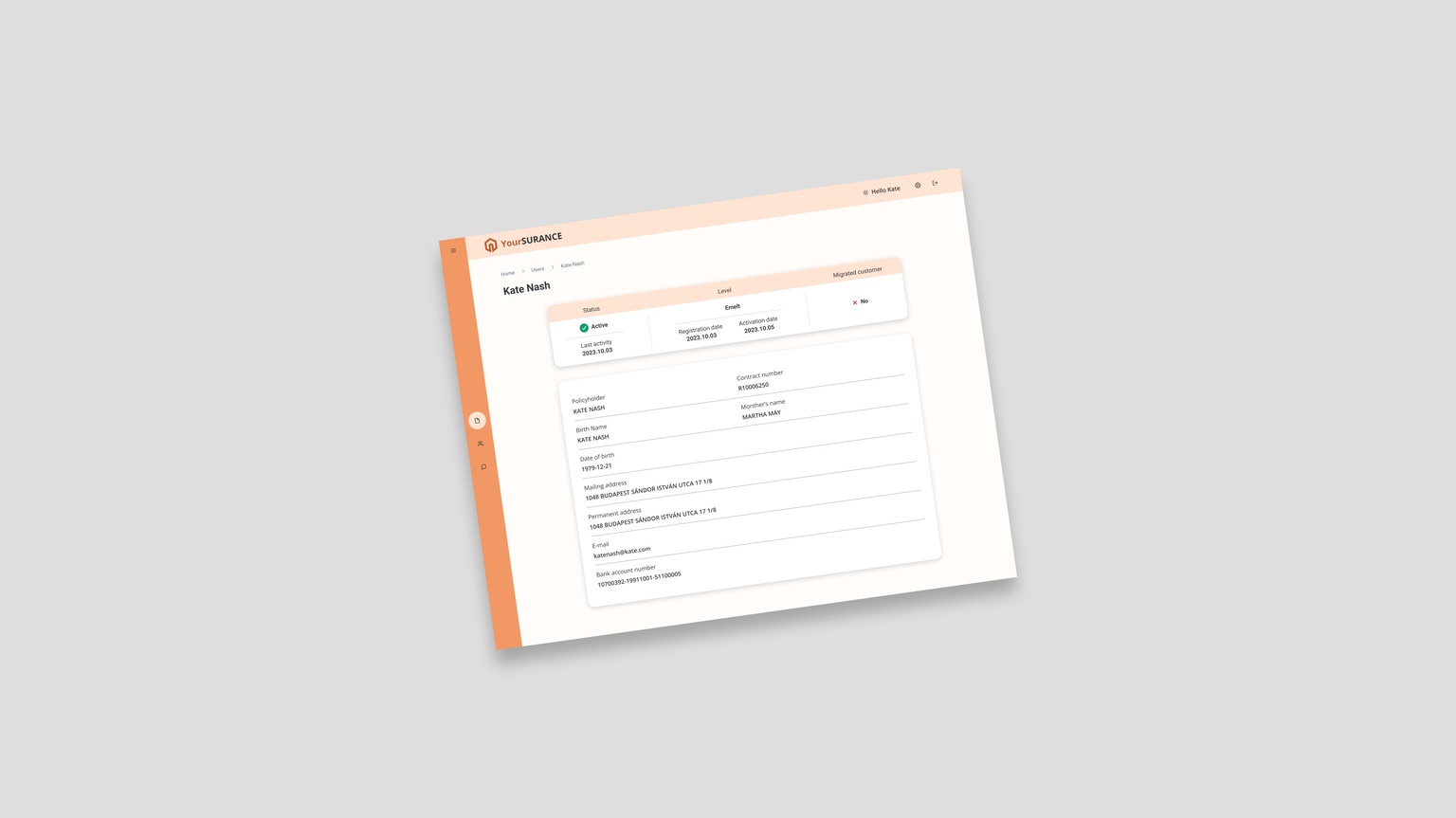

The Customer Overview equips service representatives with a complete 360° view of each policyholder. From policy details, claims history, and payment status to recent interactions and contact information, all relevant data is presented in a single, intuitive interface. This consolidated view enables agents to resolve inquiries faster, personalize support, and anticipate customer needs — ultimately improving service quality and strengthening client relationships.

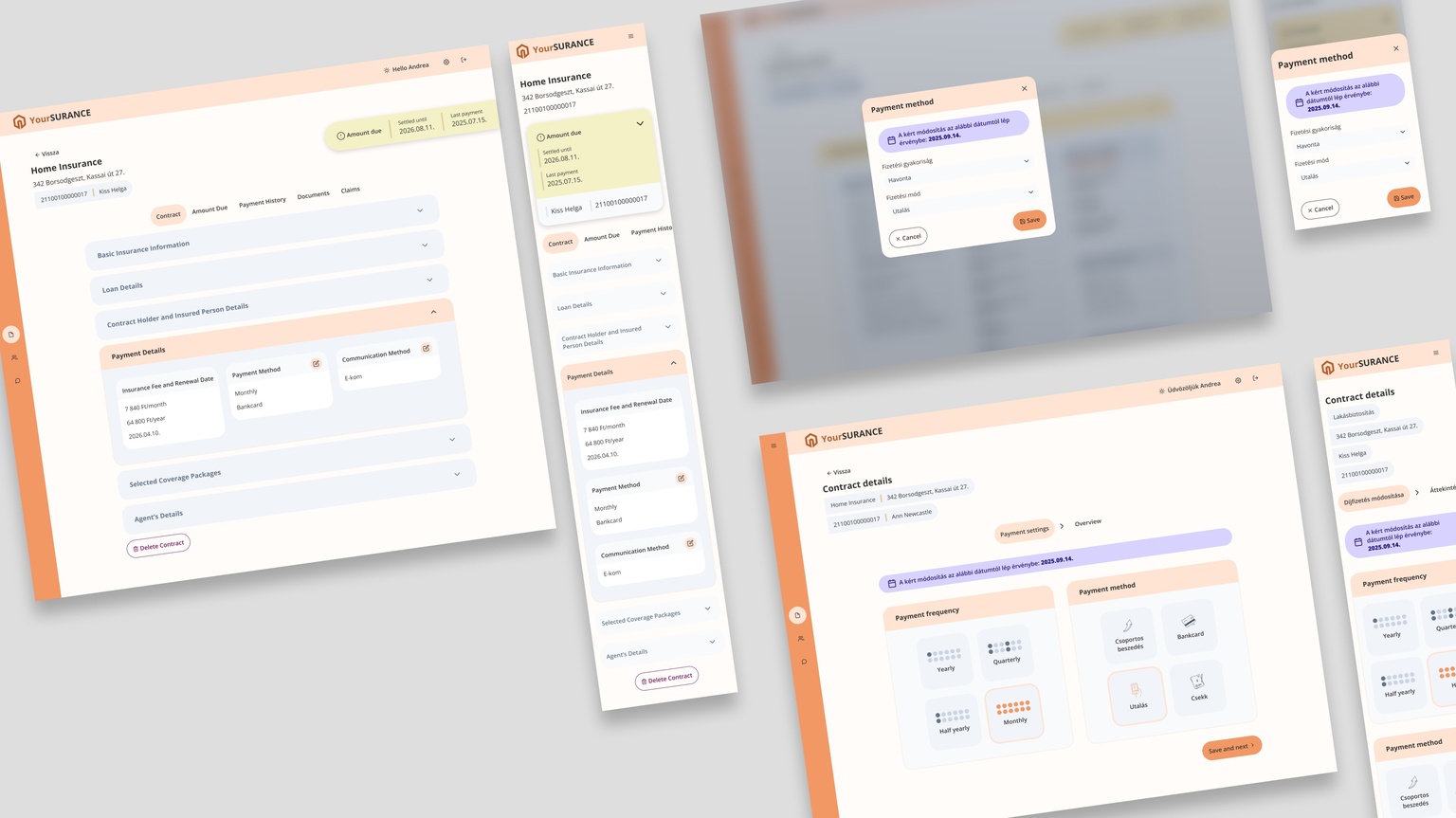

Our intuitive digital platform empowers your agents and customer service representatives with complete control over policy management, enabling efficient and accurate client interactions. Your teams gain instant, transparent access to detailed policy overviews, including comprehensive information on coverages, terms, clauses, discounts, savings, annual amounts, surrender amounts, and beneficiary handling.Beyond viewing, the platform facilitates seamless policy modifications directly within the system. Your representatives can effortlessly execute diverse changes on behalf of clients, such as investment modifications (including buybacks, additional premiums, and portfolio rebalancing), premium adjustments, and updates to payment modes or frequencies. Furthermore, agents can easily manage and update customer data (name, address, email, phone), ensuring all client information is current and accurate. This robust functionality streamlines service processes, enhances interaction quality, and optimizes operational efficiency for your entire workforce.

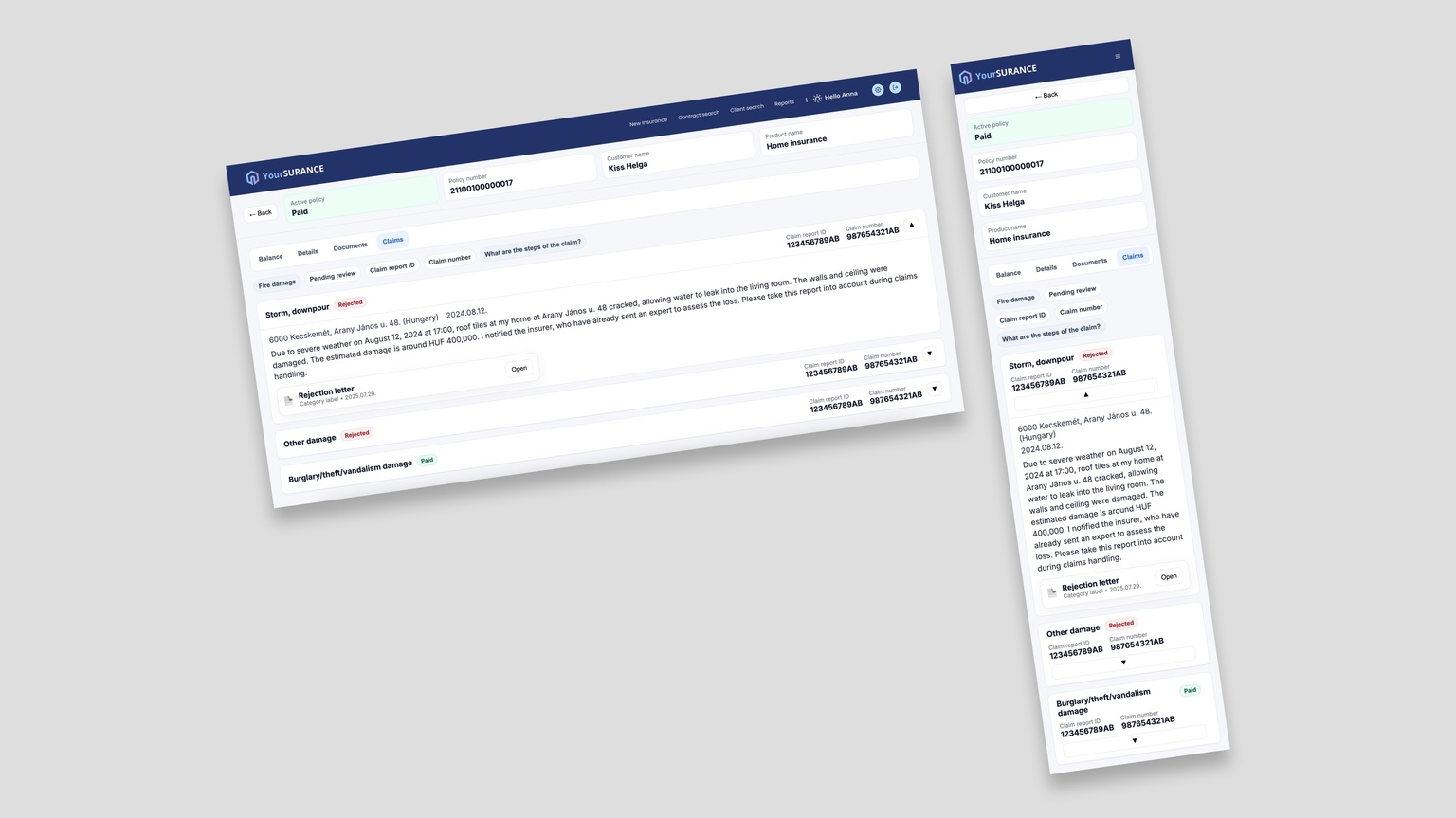

Optimize your entire claims workflow with our advanced Claim Management solution, designed for maximum efficiency and transparency. This powerful system provides a centralized hub for comprehensive claims overview, giving your team immediate insight into the status and details of every ongoing case. Crucially, our development facilitates seamless document deficiency handling, allowing for swift identification and proactive request of missing paperwork, significantly accelerating the claims process. Furthermore, the integrated Claim Tracker not only monitors the progress of each claim in real-time but also offers robust intervention capabilities, empowering adjusters to take timely action, manage exceptions, and guide the claim to a swift and fair resolution. This results in reduced processing times, enhanced control, and superior claimant satisfaction.

Personalized Payment Links: Streamlining Collections & Enhancing Customer Service Empower your customer service teams with a highly effective tool for managing premium collections and optimizing payment interventions. Our solution enables your client-facing representatives to generate and instantly dispatch personalized payment links directly to policyholders via email or SMS. This intuitive feature significantly simplifies the payment process for your clients, ensuring timely settlement of due premiums. Furthermore, it empowers your service teams to proactively manage payment reminders and follow-ups within the intervention process, reducing manual effort, accelerating collections, and ultimately enhancing both operational efficiency and customer satisfaction.

Lead tracking

Customer management and offer customisation

Workflow management

Alerts, to-dos, follow-ups

Quotation, premium calculator

Portfolio view

Policy details

Payment mode

Customer data modification

Claim entry

Claim Tracker and document handling module

Cross-sell/Upsell Suggestions

Bank Assurance

Our Bancassurance Platform: Seamlessly Integrating Insurance Sales into Your Core Banking Experience.

Our specialized Bancassurance Platform transforms the way bank agents engage with insurance products, providing an intuitive and fully integrated digital environment. Designed specifically for bank branches and remote sales, this solution empowers agents to seamlessly offer, quote, and bind insurance policies directly alongside banking services. It provides instant access to comprehensive product information, streamlines complex cross-selling processes, and ensures regulatory compliance, enabling bank agents to unlock new revenue streams and enhance client loyalty through holistic financial advice.

Empowering Bank Agents for Seamless Sales Unlock new revenue streams and strengthen client engagement with our Bancassurance Sales Platform. Purpose-built for bank branch advisors and digital channels, this intuitive sales interface enables teams to offer, quote, and bind insurance policies directly at the point of customer interaction. The solution integrates seamlessly into existing banking environments, providing real-time product information, simplifying cross-selling, and ensuring full regulatory compliance. By transforming the sales journey into an efficient, client-centric experience, it empowers bank agents to deliver holistic advice, accelerate policy issuance, and drive growth across the bancassurance portfolio — all without the need for extensive branch staff training.

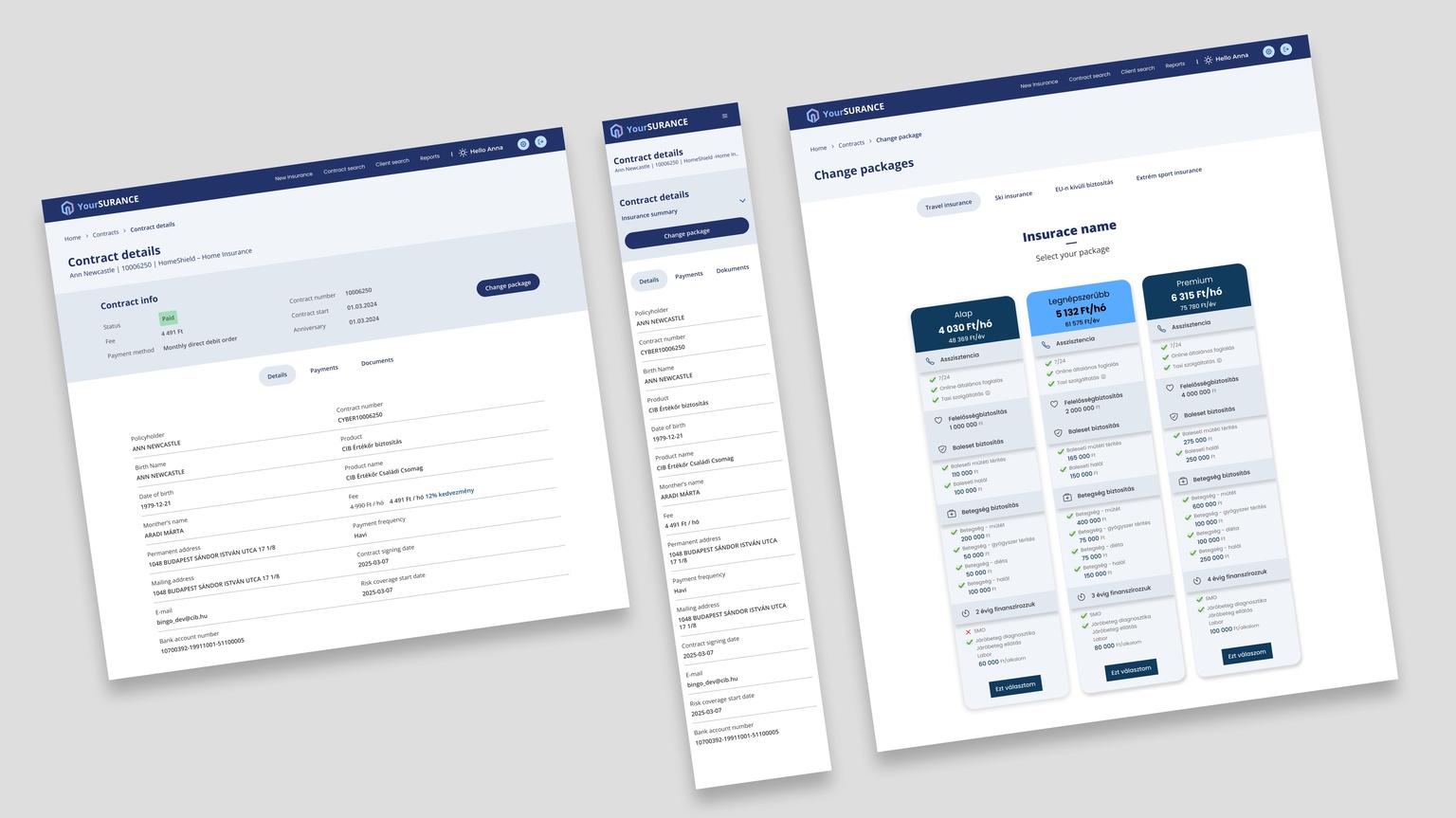

Efficient Policy Management & Upselling Our Platform strengthens both sales and service by equipping bank agents with powerful tools for policy management. Through advanced search, agents can instantly locate and review existing contracts with full access to policy details and client history. The platform also enables seamless upgrades and modifications, allowing agents to guide clients through product enhancements or alternative coverage options directly within the system. This not only streamlines the customer service experience but also creates valuable upselling opportunities — maximizing policy value and fostering stronger client relationships through proactive, personalized advice.

Our solution streamlines bancassurance operations by delivering the critical data needed for flawless system synchronization. It can automatically generate input files for multiple banking platforms — or integrate directly with legacy systems to enable automated premium collection and financial postings. By ensuring the timely and precise transfer of policy and payment data, the solution reduces manual effort, minimizes errors, and boosts the efficiency of inter-system financial operations. This reliable data flow keeps banking and insurance systems perfectly aligned, ensuring smooth premium collection and reconciliation.

Enhance your bank’s digital offering by giving customers direct, intuitive access to their insurance products and services. Our specialized Bancassurance Client Modules integrate seamlessly into your existing online banking platform, creating a consistent and unified digital experience. As a white-label solution, they let customers view policies, check coverage details, pay premiums, and initiate claims — all within the familiar bank environment. By consolidating financial and insurance services into one hub, your bank can deepen relationships, boost engagement, and drive more value from your bancassurance portfolio.

Claims Management Platform

Streamlining your entire claims process, our advanced Claims Management Platform ensures rapid incident reporting, intelligent assessment, efficient repairer coordination, and transparent tracking, leading to faster settlements and enhanced customer satisfaction.

Our comprehensive Claims Management Platform transforms the complex claims journey into a seamless, efficient, and transparent experience for both policyholders and adjusters. From intuitive digital incident reporting and automated document handling to an integrated expert system for intelligent assessment, the platform accelerates every step. It enables efficient repairer network coordination, provides real-time claim tracking for all stakeholders, and integrates seamlessly with your existing systems – ultimately reducing processing times, lowering operational costs, and significantly improving claimant satisfaction and trust.

Omni-Platform Digital Claim Submission – Efficiency with Empathy Revolutionize your claims process with our intuitive digital claim submission module, designed for seamless access and utilization across all key stakeholders – from policyholders initiating claims on your website or mobile app, to agents, call center, and customer service teams processing notifications internally. A guided, step-by-step interface ensures accuracy and completeness — even in stressful situations. By providing a transparent, user-friendly channel for all parties, this solution reduces administrative effort and transforms claims initiation into a reassuring, efficient experience across your entire ecosystem.

Omni-Channel Claim Tracker – Real-Time Transparency for All Gain complete clarity and control over every claim with our intuitive omni-channel Claim Tracker. Providing real-time updates and status insights, it gives policyholders, agents, and internal teams instant visibility into claim progress — from first notice to final settlement, across their preferred digital channels. The tracker centralizes information, simplifies complex processes, and fosters proactive engagement. Missing documents are identified instantly, ensuring quick resolution for all relevant parties. For adjusters and internal staff, it also provides powerful intervention tools, enabling timely action and direct exception handling within the tracking interface. This unified, transparent approach strengthens communication, improves efficiency, and drives higher claimant satisfaction at every touchpoint.

Comprehensive Claims Management Platform Transform claims operations with our advanced solution, delivering full control and efficiency from FNOL to final settlement. It unifies all processes, streamlines workflows, and enhances transparency at every stage. At its core is a dynamic Claim Dashboard, giving managers and adjusters a real-time view of the entire portfolio. With clear insights into volumes, processing times, settlement ratios, and resource use, teams can spot bottlenecks, allocate resources effectively, and make faster, smarter decisions. By centralizing data and providing actionable intelligence, the solution drives efficiency, reduces costs, and ensures a better experience for both teams and policyholders.

Lead tracking

Customer management and offer customisation

Customer History, existing contracts, interaction records

Client profile management

Workflow management

Alerts, to-dos, follow-ups

Quotation, premium calculator

Product recommendation

Underwriting

Portfolio view

Policy details

Payment mode

Customer data modification

Claim entry

Claim Tracker and document handling module

Campaign Management

Embedded Training, Product Documentation

Cross-sell/Upsell Suggestions

Contact

Great partnerships start with a conversation

Our goal is to deliver tailored solutions that make a real impact. Get in touch with us and let's find the best path forward together.

Károly Halmosi

For business-related inquiries

+36 20 777 3522

Sarolta Fogarasi

For technical inquiries in insurance domain

+36 20 663 4256